- Zachary Bouck

- Jan 24, 2025

- 6 min read

Updated: May 8, 2025

Denver Wealth Management Technology Trends 2025

Writing an annual outlook is an exercise in futility. To loosely paraphrase Don Rumsfeld, there are ‘unknown unknowns,’ things that we don’t even know we don’t know. While that uncertainty provides a constant humility in making any predictions, we can at a minimum start with what we do know. From there, we can balance our base of knowledge with what we know we don’t know and begin filtering out less likely scenarios and adding more likely scenarios.

Instead of my annual ‘investment predictions’ I’m changing the format to ‘Technology Trends.’ The cutting edge is fun to write about, but it’s really the long term verifiable trends that matter the most. Personal computers, smart phones, cloud computing, software-as-a-service companies. These are all trends that have made investors fortunes over the past 25 years, and we expect similar dominant trends to continue in the next 25 years.

Looking back at the last quarter-century from the vantage point of year end 2024, the dominant story of the past 25 years is how hand-held devices have made amazing changes in our day-to-day lives. From Uber, to photography, to entertainment, smart phones are the brains we never dreamt of 20 years ago.

And their economic power has richly rewarded equity investors. Companies like Apple, Google, Microsoft, Facebook, and Amazon have risen dramatically and has resulted in the Dow Jones Technology Index returning a staggering 20.80% annualized return over the past ten years.

There is an interesting principle in computing about the speed at which chips can solve problems. Dubbed Moore’s Law, it is roughly the idea that the number of transistors in an integrated circuit can double every two years.

While this framework for understanding potential increases in computing power has proven useful over the past 50 years, computing power has now reached a limit whereby future doubles are harder and more complicated. While Moore’s prediction has been useful, we are reaching a terminal state of easy computing power where future gains will be harder and slower.

We have also reached a level of stagnation when it comes to novel uses of the smart phone. Innovation will continue, but at a slower pace. This means that while investment returns will likely continue to come from what we have dubbed ‘Platform Companies,’ the wave of exponential return will likely come from a different source.

Looking back from 2050, what will the investment story be? Some innovations are likely outside of prediction. If you were to lay wagers at the most likely, we are betting that the power of computers to radically transform our lives are entering a new stage. Wall Street crudely refers to this as "AI." We think that phrase is a good catch all, but not particularly useful when it comes to putting real mental energy into the potential outcomes and usefulness of computing power. The real magic of 'AI' is the new way we have learned to use computers. While previous computers took a somewhat literal search query and used a basic process to generate a result, the new way computers can search, curate, and present information looks as if it will truly uproot the world.

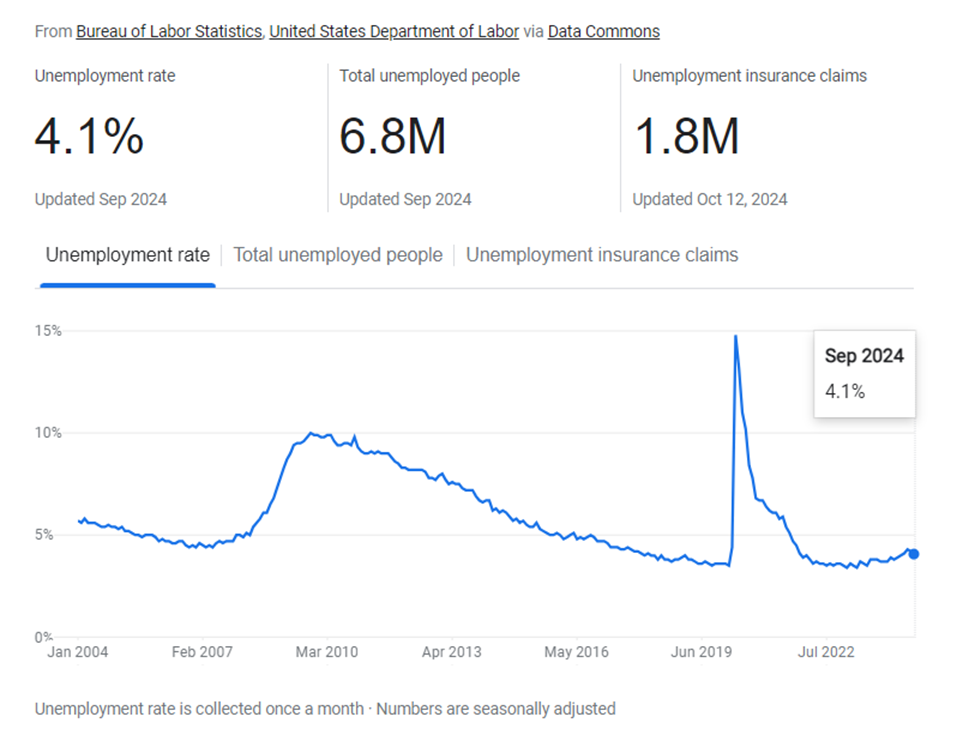

Trend #1 Computing Power reduces White Collar Jobs dramatically

The trend that seems most likely is computing power reducing the need for white collar workers. There have been two big waves of technology replacing human workers: first Agrarian, then manufacturing.

I believe, Service workers are next.

Agrarian

“The share of the US workforce employed on farms fell from 90% in 1790 to less than 2% today.” https://humanprogress.org/trends/the-changing-nature-of-work/

Manufacturing

“Manufacturing employment peaked at 38% in 1944, by 2019 it had fallen to 8.5%.

Service

‘The share of workers employed in the service sector rose from 31% in 1900 to 78% in 1999. In 2016 it stood at 81%.” Just as farm machinery and technology reduced the farming labor force, and machinery severely reduced the amount of manufacturing workers in the US, get ready office workers. AI will substantially reduce the need for people employed in offices engaged in ‘white collar’ work

.

The number of people who sit in front of a computer and organize, search, or format data will be reduced, on a 10:1 scale. The profession of 'computer-looker-atter' is going away, and we as investors need to think about where and what businesses will benefit the most, and which will suffer.

Theme #2 Automated Driving

In 2022, there were approximately 6 million car accidents reported in the US. Vehicle deaths range between 40,000 and 45,000 most years. The average one-way commute in the US is 26.8 minutes and total daily commute time is 53.6 minutes, a number I’m happy to round up to one hour.

The average car is used only 3 hours per week, which means it sits idle 141 hours per week. Additionally, 50-60% of land inside metro areas is set aside for car parking. Humans have only had autos for about 100 years, and our relationship with these glorious transportation machines is still evolving. If regulation continues to favor self-driving over human-driven cars, the technology will have vast impacts over the next 25 years.

For example, if that hour long commute, we just identified is done in a self-driving car, that time is now productive in both directions. As you drive from your office to a meeting, you can continue to work on your computer, while your self-driving car safely shepherds you home. Why not kick back and watch a movie? Play Chess? Anything but stare at the brake lights on the interstate.

You could have your self-driving Tesla drive your kids to school, or even rent out your Tesla to auto-drive other people around.

Not only are self-driving cars less expensive to operate, their 6 times safer, on average, than human drivers. Safer cars cost less in insurance and reduce congestion.

Winners in this category will necessitate some losers. Legacy car companies that can’t adapt will fail. Technology companies that can produce cars or hardware to outfit cars will win.

Theme #3 Drone War Fare Dominates the Battle Field

Humans have been killing each other forever. If you’ve read the bible, the first humans not created by God start human history with a murder. Cain & Able is not just a hipster restaurant, it’s the story of mankind.

Ever since that attack in the ancient field, humans have been getting better at killing and defending against the attackers.

Abel’s rock became a club, became swords, became guns, became bombs, became tanks, became airplanes, became drones. (I know in the picture above Cain has a club, but in the bible I read as a kid he had a rock.)

The conflict in Ukraine has re-written many of the current military ideas that we had prior to the Ukraine Russian conflict. Drones, even retail and low sophistication drones are game changers on the battlefield. Small drones with single grenades attached have not only killed countless soldiers but have also led to video-gamers effectively becoming lethal soldiers.

Elon musk weighed in on X, arguing that manned aircraft are no longer going to be a factor in warfare. Drones are not limited by a human’s ability to handle G-forces, but aircraft piloted by individuals are.

With drones phasing into wars, not only will one type of combat end, but a new one will begin. Already in the Ukraine-Russia conflict, being able to pick up drone frequencies of your enemies can help win valuable conflicts on the battlefield. Stealing control of their drones will allow you to take over their weapons.

As far as investments are concerned the US spent $820 Billion dollars, a significant amount that will be redirected to new companies in the coming years.

I won’t review some of the likely benefactors, but the undeniable trend, is that drone warfare, and by extension, counter-drone warfare will become extremely important on the global battlefield.

These three trends are undeniable. Humans are being replaced by AI in service work, self-driving technology is improving everyday, and warfare is being reinvented by drones. The opportunities are ample for those willing to do the homework and invest accordingly.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.